what two characteristics must an item possess to have monetary value

24.1 What Is Money?

Learning Objectives

- Ascertain coin and discuss its three bones functions.

- Distinguish between commodity money and fiat money, giving examples of each.

- Define what is meant by the money supply and tell what is included in the Federal Reserve System's two definitions of it (M1 and M2).

If cigarettes and mackerel tin be used equally coin, and then but what is money? Money is anything that serves every bit a medium of exchange. A medium of substitution is annihilation that is widely accepted as a ways of payment. In Romania under Communist Political party dominion in the 1980s, for case, Kent cigarettes served as a medium of exchange; the fact that they could be exchanged for other goods and services made them money.

Money, ultimately, is defined past people and what they do. When people use something as a medium of commutation, it becomes money. If people were to begin accepting basketballs equally payment for nearly goods and services, basketballs would be money. We will learn in this affiliate that changes in the fashion people utilise money have created new types of coin and inverse the way money is measured in recent decades.

The Functions of Money

Coin serves 3 basic functions. By definition, it is a medium of exchange. It as well serves equally a unit of measurement of account and as a store of value—as the "mack" did in Lompoc.

A Medium of Exchange

The exchange of goods and services in markets is among the most universal activities of homo life. To facilitate these exchanges, people settle on something that volition serve equally a medium of exchange—they select something to be money.

We tin can understand the significance of a medium of substitution by considering its absence. Barter occurs when goods are exchanged directly for other goods. Because no 1 item serves as a medium of commutation in a barter economy, potential buyers must find things that private sellers will accept. A heir-apparent might find a seller who will trade a pair of shoes for two chickens. Some other seller might be willing to provide a haircut in exchange for a garden hose. Suppose you were visiting a grocery store in a barter economy. You lot would need to load up a truckful of items the grocer might have in substitution for groceries. That would exist an uncertain thing; you could not know when you headed for the shop which items the grocer might concur to trade. Indeed, the complication—and cost—of a visit to a grocery shop in a barter economy would be so great that there probably would not exist whatsoever grocery stores! A moment's contemplation of the difficulty of life in a barter economic system volition demonstrate why human societies invariably select something—sometimes more than ane thing—to serve as a medium of exchange, just as prisoners in federal penitentiaries accustomed mackerel.

A Unit of Account

Ask someone in the Usa what he or she paid for something, and that person will answer by quoting a price stated in dollars: "I paid $75 for this radio," or "I paid $xv for this pizza." People do non say, "I paid five pizzas for this radio." That argument might, of class, be literally true in the sense of the opportunity cost of the transaction, but we practise not study prices that fashion for two reasons. One is that people do non get in at places like Radio Shack with v pizzas and expect to buy a radio. The other is that the data would not be very useful. Other people may not think of values in pizza terms, then they might not know what we meant. Instead, we report the value of things in terms of money.

Coin serves every bit a unit of business relationship, which is a consistent means of measuring the value of things. We use money in this fashion because it is also a medium of exchange. When we report the value of a good or service in units of money, nosotros are reporting what another person is likely to accept to pay to obtain that good or service.

A Shop of Value

The third function of coin is to serve as a shop of value, that is, an item that holds value over time. Consider a $twenty bill that you accidentally left in a glaze pocket a yr ago. When y'all detect it, you will exist pleased. That is because you lot know the pecker still has value. Value has, in issue, been "stored" in that trivial slice of paper.

Money, of course, is non the but thing that stores value. Houses, role buildings, land, works of fine art, and many other commodities serve every bit a means of storing wealth and value. Coin differs from these other stores of value by being readily exchangeable for other bolt. Its part as a medium of exchange makes it a convenient store of value.

Because money acts as a store of value, information technology can exist used equally a standard for future payments. When yous borrow money, for instance, you lot typically sign a contract pledging to brand a serial of time to come payments to settle the debt. These payments will be made using money, because money acts as a store of value.

Money is not a take chances-gratuitous store of value, however. We saw in the chapter that introduced the concept of inflation that inflation reduces the value of money. In periods of rapid inflation, people may not desire to rely on money as a store of value, and they may turn to commodities such as state or gilt instead.

Types of Coin

Although money can accept an extraordinary variety of forms, in that location are really only ii types of money: money that has intrinsic value and money that does not have intrinsic value.

Commodity money is money that has value apart from its use as money. Mackerel in federal prisons is an example of commodity money. Mackerel could be used to buy services from other prisoners; they could also be eaten.

Gold and silver are the most widely used forms of commodity money. Gilded and silver can be used as jewelry and for some industrial and medicinal purposes, and then they have value apart from their apply equally coin. The start known use of gold and silver coins was in the Greek urban center-land of Lydia in the showtime of the seventh century B.C. The coins were fashioned from electrum, a natural mixture of gold and silver.

One disadvantage of article money is that its quantity can fluctuate erratically. Gilt, for example, was one form of money in the United States in the 19th century. Gilt discoveries in California and later in Alaska sent the quantity of coin soaring. Some of this nation's worst bouts of inflation were set off by increases in the quantity of gilt in circulation during the 19th century. A much greater problem exists with commodity money that can be produced. In the southern part of colonial America, for case, tobacco served as money. There was a continuing trouble of farmers increasing the quantity of coin by growing more than tobacco. The problem was sufficiently serious that vigilante squads were organized. They roamed the countryside called-for tobacco fields in an effort to go along the quantity of tobacco, hence money, under control. (Remarkably, these squads sought to command the money supply past called-for tobacco grown by other farmers.)

Another problem is that commodity money may vary in quality. Given that variability, at that place is a trend for lower-quality commodities to drive college-quality commodities out of circulation. Horses, for case, served as money in colonial New England. It was common for loan obligations to be stated in terms of a quantity of horses to be paid dorsum. Given such obligations, there was a tendency to use lower-quality horses to pay back debts; higher-quality horses were kept out of circulation for other uses. Laws were passed forbidding the employ of lame horses in the payment of debts. This is an example of Gresham's law: the tendency for a lower-quality article (bad money) to drive a higher-quality commodity (good coin) out of circulation. Unless a means tin be constitute to control the quality of commodity money, the trend for that quality to refuse can threaten its acceptability every bit a medium of exchange.

But something need not have intrinsic value to serve as money. Fiat money is coin that some authorization, generally a regime, has ordered to be accepted as a medium of commutation. The currency—paper money and coins—used in the U.s. today is fiat coin; it has no value other than its apply equally money. You will discover that argument printed on each neb: "This note is legal tender for all debts, public and private."

Checkable deposits, which are balances in checking accounts, and traveler'due south checks are other forms of coin that take no intrinsic value. They can exist converted to currency, merely generally they are not; they simply serve as a medium of exchange. If you want to buy something, you can often pay with a check or a debit card. A check is a written guild to a bank to transfer ownership of a checkable deposit. A debit card is the electronic equivalent of a cheque. Suppose, for case, that you accept $100 in your checking account and you write a check to your campus bookstore for $xxx or instruct the clerk to swipe your debit card and "charge" it $xxx. In either case, $30 volition be transferred from your checking account to the bookstore's checking account. Notice that it is the checkable deposit, not the bank check or debit carte, that is coin. The bank check or debit card but tells a banking company to transfer money, in this case checkable deposits, from one account to another.

What makes something money is really plant in its acceptability, not in whether or not it has intrinsic value or whether or not a government has declared it as such. For example, fiat money tends to exist accepted so long equally also much of it is not printed likewise speedily. When that happens, as it did in Russia in the 1990s, people tend to await for other items to serve as money. In the instance of Russia, the U.Southward. dollar became a popular form of money, even though the Russian government still declared the ruble to be its fiat money.

Heads Up!

The term coin, as used by economists and throughout this volume, has the very specific definition given in the text. People tin agree assets in a variety of forms, from works of art to stock certificates to currency or checking account balances. Fifty-fifty though individuals may be very wealthy, only when they are holding their assets in a class that serves as a medium of exchange practice they, according to the precise meaning of the term, have "money." To qualify as "money," something must be widely accepted equally a medium of exchange.

Measuring Coin

The full quantity of money in the economy at whatever once is called the money supply. Economists measure the money supply because information technology affects economic activity. What should be included in the money supply? Nosotros want to include as part of the money supply those things that serve as media of commutation. Nevertheless, the items that provide this function have varied over fourth dimension.

Earlier 1980, the basic coin supply was measured as the sum of currency in circulation, traveler'southward checks, and checkable deposits. Currency serves the medium-of-exchange function very nicely only denies people any interest earnings. (Checking accounts did not earn involvement earlier 1980.)

Over the concluding few decades, especially as a issue of high interest rates and high inflation in the late 1970s, people sought and found ways of holding their financial avails in ways that earn interest and that tin easily be converted to money. For case, it is now possible to transfer money from your savings account to your checking business relationship using an automated teller automobile (ATM), and so to withdraw cash from your checking business relationship. Thus, many types of savings accounts are easily converted into currency.

Economists refer to the ease with which an nugget can be converted into currency as the asset's liquidity. Currency itself is perfectly liquid; you tin can always change two $5 bills for a $10 neb. Checkable deposits are almost perfectly liquid; yous can hands greenbacks a check or visit an ATM. An office building, however, is highly illiquid. Information technology can be converted to money only by selling it, a time-consuming and plush process.

As fiscal assets other than checkable deposits have get more liquid, economists take had to develop broader measures of coin that would correspond to economic activity. In the U.s.a., the final arbiter of what is and what is not measured as coin is the Federal Reserve System. Because information technology is difficult to make up one's mind what (and what non) to measure as money, the Fed reports several unlike measures of money, including M1 and M2.

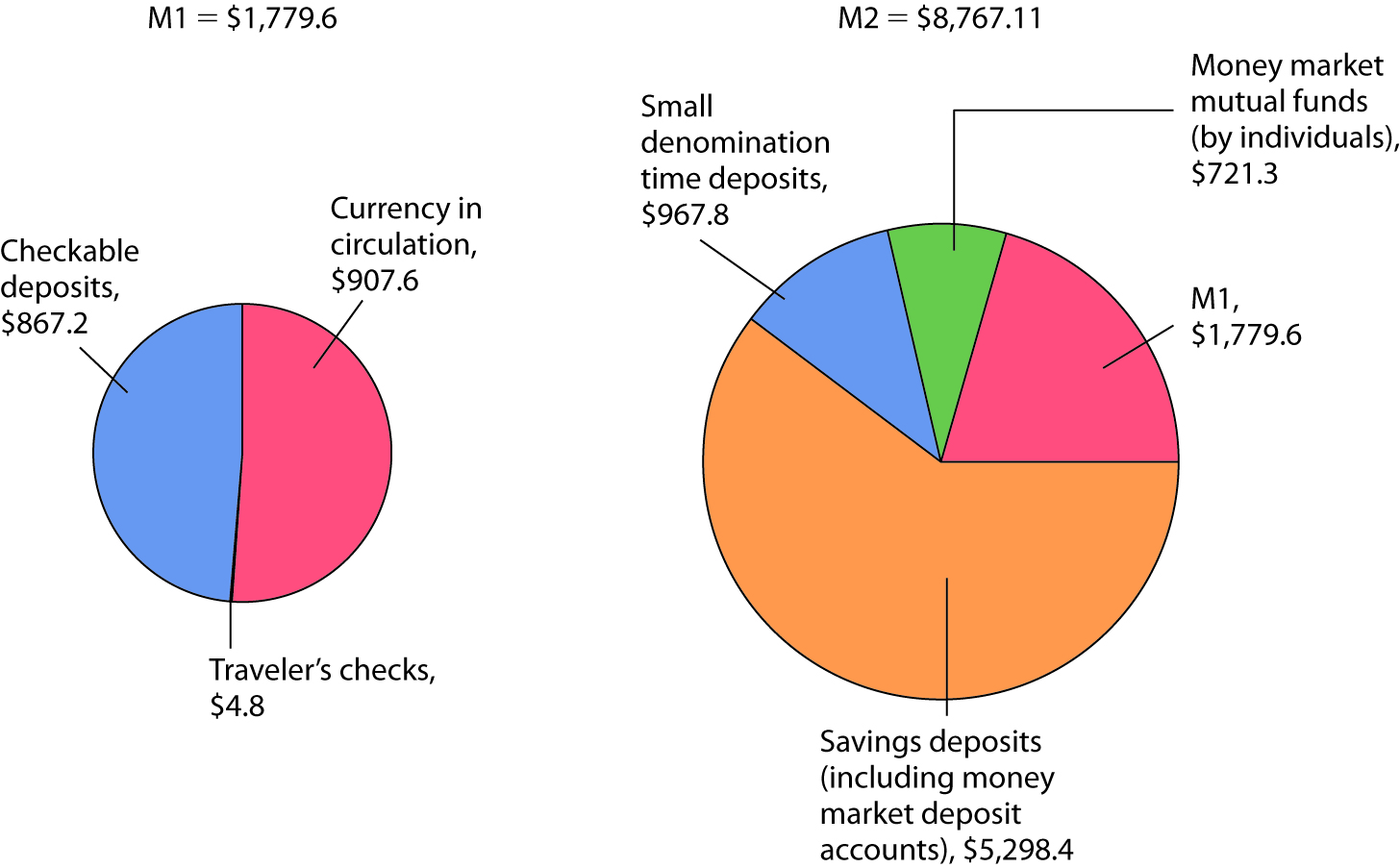

M1 is the narrowest of the Fed'due south money supply definitions. Information technology includes currency in circulation, checkable deposits, and traveler'southward checks. M2 is a broader measure out of the money supply than M1. Information technology includes M1 and other deposits such as modest savings accounts (less than $100,000), as well equally accounts such as money market common funds (MMMFs) that place limits on the number or the amounts of the checks that can be written in a certain period.

M2 is sometimes called the broadly defined money supply, while M1 is the narrowly defined money supply. The assets in M1 may be regarded every bit perfectly liquid; the assets in M2 are highly liquid, just somewhat less liquid than the avails in M1. Even broader measures of the money supply include large time-deposits, coin market mutual funds held past institutions, and other assets that are somewhat less liquid than those in M2. Figure 24.1 "The Ii Ms: October 2010" shows the composition of M1 and M2 in Oct 2010.

Effigy 24.1 The 2 Ms: Oct 2010

M1, the narrowest definition of the money supply, includes assets that are perfectly liquid. M2 provides a broader measure of the money supply and includes somewhat less liquid assets. Amounts represent coin supply data in billions of dollars for October 2010, seasonally adjusted.

Source: Federal Reserve Statistical Release H.half-dozen, Tables 3 and iv (December two, 2010). Amounts are in billions of dollars for Oct 2010, seasonally adapted.

Heads Up!

Credit cards are not money. A credit card identifies y'all as a person who has a special arrangement with the card issuer in which the issuer volition lend y'all money and transfer the proceeds to another political party whenever you want. Thus, if you present a MasterCard to a jeweler equally payment for a $500 ring, the house that issued you the bill of fare will lend y'all the $500 and send that money, less a service charge, to the jeweler. You, of course, will be required to repay the loan later. But a menu that says you have such a relationship is not money, just as your debit card is not money.

With all the operational definitions of money available, which i should we use? Economists mostly respond that question past asking another: Which measure of money is most closely related to real GDP and the price level? Equally that changes, and so must the definition of money.

In 1980, the Fed decided that changes in the ways people were managing their money made M1 useless for policy choices. Indeed, the Fed now pays little attending to M2 either. Information technology has largely given up tracking a particular measure out of the money supply. The option of what to mensurate as money remains the field of study of continuing research and considerable debate.

Key Takeaways

- Money is anything that serves equally a medium of exchange. Other functions of coin are to serve as a unit of account and as a shop of value.

- Coin may or may non accept intrinsic value. Commodity money has intrinsic value because information technology has other uses besides being a medium of exchange. Fiat money serves only as a medium of commutation, because its utilize as such is authorized by the government; it has no intrinsic value.

- The Fed reports several different measures of money, including M1 and M2.

Endeavor Information technology!

Which of the following are money in the U.s.a. today and which are not? Explain your reasoning in terms of the functions of money.

- Gilt

- A Van Gogh painting

- A dime

Instance in Betoken: Fiat-less Money

"We don't have a currency of our own," proclaimed Nerchivan Barzani, the Kurdish regional regime'southward prime minister in a news interview in 2003. But, even without official recognition past the government, the so-called "Swiss" dinar certainly seemed to office every bit a fiat money. Here is how the Kurdish area of northern Iraq, during the menstruum betwixt the Gulf War in 1991 and the fall of Saddam Hussein in 2003, came to have its own currency, despite the pronouncement of its prime minister to the reverse.

After the Gulf State of war, the northern, generally Kurdish expanse of Iraq was separated from the rest of Republic of iraq though the enforcement of the no-fly-zone. Because of United Nations sanctions that barred the Saddam Hussein regime in the south from continuing to import currency from Switzerland, the primal depository financial institution of Iraq announced information technology would supercede the "Swiss" dinars, so named because they had been printed in Switzerland, with locally printed currency, which became known as "Saddam" dinars. Iraqi citizens in southern Iraq were given three weeks to substitution their onetime dinars for the new ones. In the northern part of Iraq, citizens could non exchange their notes and so they simply continued to utilize the old ones.

And so information technology was that the "Swiss" dinar for a period of about 10 years, even without government bankroll or any police establishing it as legal tender, served every bit northern Iraq's fiat coin. Economists use the word "fiat," which in Latin means "allow it exist done," to depict money that has no intrinsic value. Such forms of money commonly get their value because a government or say-so has alleged them to be legal tender, simply, as this story shows, information technology does not really crave much "fiat" for a convenient, in-and-of-itself worthless, medium of exchange to evolve.

What happened to both the "Swiss" and "Saddam" dinars? Later the Coalition Conditional Authority (CPA) assumed command of all of Iraq, Paul Bremer, then caput of the CPA, announced that a new Iraqi dinar would be exchanged for both of the existing currencies over a three-month menses catastrophe in Jan 2004 at a rate that implied that ane "Swiss" dinar was valued at 150 "Saddam" dinars. Because Saddam Hussein's authorities had printed many more "Saddam" dinars over the ten-twelvemonth flow, while no "Swiss" dinars had been printed, and because the inexpensive printing of the "Saddam" dinars made them easy to counterfeit, over the decade the "Swiss" dinars became relatively more valuable and the exchange rate that Bremer offered about equalized the purchasing power of the two currencies. For instance, it took about 133 times every bit many "Saddam" dinars as "Swiss" dinars to buy a man's suit in Iraq at the fourth dimension. The new notes, sometimes chosen "Bremer" dinars, were printed in Britain and elsewhere and flown into Republic of iraq on 22 flights using Boeing 747s and other large aircraft. In both the northern and southern parts of Iraq, citizens turned in their old dinars for the new ones, suggesting at least more confidence at that moment in the "Bremer" dinar than in either the "Saddam" or "Swiss" dinars.

Sources: Mervyn A. Rex, "The Institutions of Budgetary Policy" (lecture, American Economics Association Annual Meeting, San Diego, January 4, 2004), available at http://www.bankofengland.co.uk/speeches/speech208.pdf. Hal R. Varian, "Paper Currency Tin can Have Value without Regime Backing, but Such Bankroll Adds Substantially to Its Value," New York Times, January 15, 2004, p. C2.

Answer to Effort Information technology! Trouble

- Gold is not money because information technology is not used as a medium of substitution. In add-on, it does not serve every bit a unit of business relationship. It may, all the same, serve as a store of value.

- A Van Gogh painting is not coin. It serves as a shop of value. It is highly illiquid just could eventually exist converted to money. It is neither a medium of exchange nor a unit of account.

- A dime is coin and serves all three functions of money. It is, of class, perfectly liquid.

Source: https://open.lib.umn.edu/principleseconomics/chapter/24-1-what-is-money/

0 Response to "what two characteristics must an item possess to have monetary value"

Post a Comment